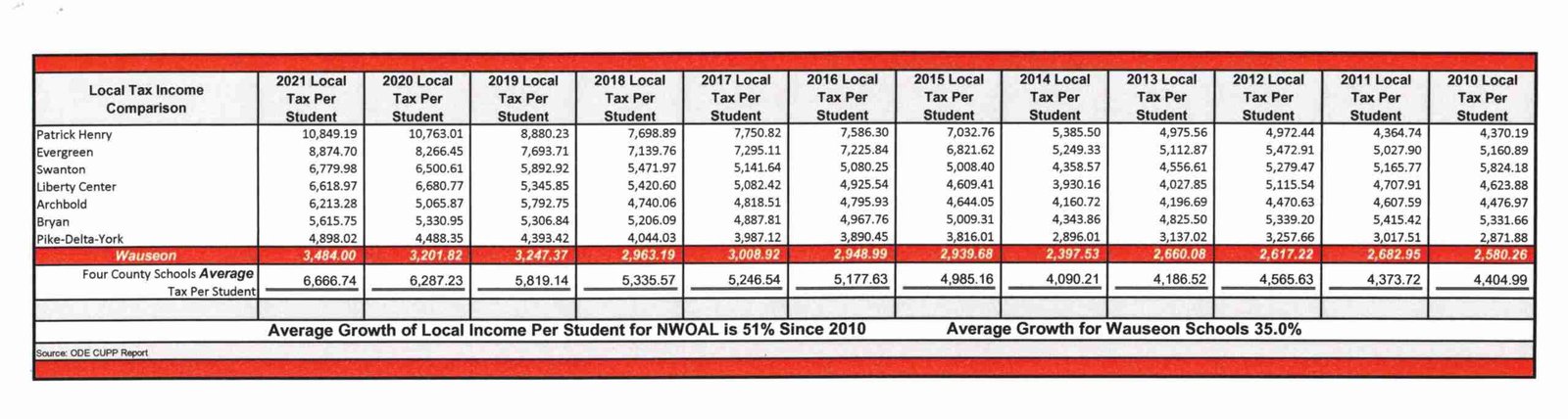

INCOME PER STUDENT… Local tax income comparisons show the amount of local funding per student the Wauseon School District receives.

INCOME PER STUDENT… Local tax income comparisons show the amount of local funding per student the Wauseon School District receives.

By: Jacob Kessler

The Wauseon School District is facing a tough financial future after the failure of its proposed 2.0% earned income tax levy back in November of 2021.

According to school officials, the passing of the levy was critical for life as normal to go on in the city’s schools.

Currently, the students that attend the schools in Wauseon are facing major cuts, and so are the teachers.

On January 10th the Wauseon Board of education voted to approve the recommendation made by Superintendent Troy Armstrong to no longer employee individuals with supplemental contracts.

This will ultimately leave the school with no athletics, clubs, or activities during the upcoming 2022-2023 school year.

The Board also took further action on February 4th to implement Ohio State guided minimum transportation standards.

Currently, all students who wish to ride the bus to the school and back to their home will be offered that opportunity.

With the new standards adopted, no student will be able to take advantage of this service who lives within two miles of their respective school building, unless they are a student with a disability.

Students with disabilities who require transportation will still be eligible.

All other students within a two-mile area of their school building will be required to find alternate transportation to and from school.

Furthermore, all high school students will be required to find alternate transportation regardless of their location in relation to their school building.

Transportation will not be offered to students who are ineligible even if another student in the household are, such as a high schooler with younger siblings.

Transportation to and from the high school for Four County students will still be offered.

Twenty staff positions are also looking to be cut from the upcoming school year in addition to the supplemental contracts.

The names of those employees who may lose their job will be released sometime during the week ending February 25th. These three measures are projected to save the district approximately $1.3 Million.

Financial reports quoting information from the Ohio Department of Education paint a picture as to why this is happening. In a list of eight schools in the four-county area, Wauseon ranks last in a local tax income comparison for tax per student.

These numbers take the local tax contributions for each school and equates the amount received to one amount per student. In 2021 this number stands at $3,484.00 per Wauseon student. Other schools listed are as follows.

Patrick Henry at $10,849.19, Evergreen at $8,874.70, Swanton at $6,779.98, Liberty Center at $6,618.97, Archbold at $6,213.28, Bryan at $5,615.75, and Pike-Delta-York at $4,898.02. The average amount per student from all schools is $6,666.74.

Reports also show staffing costs from administrator pay to year by year pay increases. From 2007 to 2021 the Wauseon School district has seen an average pay increase for its employees at 1.31% with that numbers both increasing and decreasing on a year-by-year basis.

When considering the consumer price index, the average increase for inflation rests at 2.0% with that number being 4.8% in 2021 alone. Health insurance costs have also continued to rise with the total premium cost increasing by $382,524 from 2019 to 2021.

New agreements were made with the insurance company which prevented the amount from increasing much higher as was anticipated.

The percentage of local revenue received by the district has also been decreasing since 1998 with that year showing 43.01% of the income received from local taxes. In 2008 that number was down to 36.68% and down further to 26.73% in 2020.

210 schools across Ohio currently have some type of levy in place for either earned income or a traditional tax. 63 of those schools have an earned income tax which only take a portion from monies earned in a paycheck.

147 schools receive a traditional tax which taxes a percentage of the resident’s tax base. This type of tax effects not only working residents, but retired residents as well.

The Wauseon school district is attempting to receive a 1.75% earned income tax. This will take the school from receiving $3,484.00 per student in local funding to $5,480.65. The tax levy will provide for a local funding increase of $1,798.69 per student.

The projected increase places Wauseon in a better place then where it is at currently, but still keeps it below the average total revenue per student when comparing local four county schools.

What would the average resident of Wauseon see if the 1.75% tax that is being asked for were to pass? For a modified adjusted gross income of $50,000 a year, the cost would be $875 annually.

This is also $72.92 a month or $16.83 cents per week. This option will be on the ballot for voters to decide on May 3rd.

Negative impacts put in place by the board currently will be lifted if the tax levy passes but will stay in place if the levy fails as it did in November according to Superintendent Troy Armstrong.

“The 1.75% levy is needed in order for the district to continue to provide the great service we provide to our students. Without this funding the district is projected to run out of money in the 2024 school year.”

Jacob can be reached at jacob@thevillagereporter.com